Criminals at times prey on SDIRA holders; encouraging them to open up accounts for the goal of making fraudulent investments. They frequently idiot buyers by telling them that When the investment is acknowledged by a self-directed IRA custodian, it have to be respectable, which isn’t genuine. Once again, You should definitely do extensive homework on all investments you end up picking.

Simplicity of use and Technology: A person-welcoming platform with online tools to trace your investments, submit files, and control your account is vital.

SDIRAs are sometimes utilized by palms-on investors who're ready to tackle the risks and duties of selecting and vetting their investments. Self directed IRA accounts can be great for investors who may have specialised information in a distinct segment market place they would want to spend money on.

When you’ve found an SDIRA company and opened your account, you may well be pondering how to actually begin investing. Knowledge equally the rules that govern SDIRAs, in addition to ways to fund your account, can assist to put the foundation for a future of prosperous investing.

Although there are many Positive aspects associated with an SDIRA, it’s not without its possess downsides. A lot of the frequent explanation why traders don’t opt for SDIRAs involve:

Transferring cash from one particular type of account to another variety of account, for example going funds from a 401(k) to a standard IRA.

Consequently, they tend not to advertise self-directed IRAs, which provide the pliability to take a position in the broader number of assets.

The tax strengths are what make SDIRAs desirable for many. An SDIRA might be each classic or Roth - the account form you decide on will rely largely on your own investment and tax method. Check together with your economical advisor or tax advisor in case you’re Not sure which happens to be best for you personally.

And since some SDIRAs for example self-directed common IRAs are topic to expected minimum distributions (RMDs), you’ll must system in advance to make sure that you might have plenty of liquidity to meet The principles set with the IRS.

Put only, if you’re seeking a tax successful way to construct a portfolio that’s extra personalized to your interests and know-how, an SDIRA may very well be the answer.

Larger investment possibilities indicates you could diversify your portfolio further than shares, bonds, and mutual cash and hedge your portfolio from market place fluctuations and volatility.

Customer Support: Look for a supplier that offers dedicated support, such as access to knowledgeable specialists who can reply questions about compliance and IRS regulations.

Research: It really is termed "self-directed" for your explanation. With the SDIRA, you will be completely to blame for completely exploring and vetting investments.

Introducing money on to your account. Keep in mind that contributions are matter to yearly IRA contribution boundaries established via the IRS.

Not like stocks and bonds, alternative assets in many cases are more challenging to sell or my latest blog post can come with rigid contracts and schedules.

No, You can not spend money on your very own enterprise using a self-directed IRA. The IRS prohibits any transactions among your IRA as well as your own business because you, as the proprietor, are viewed as a disqualified person.

Sure, property is among our purchasers’ most favored investments, at times known as a real estate IRA. Shoppers have the option to speculate in anything from rental Homes, business real estate, undeveloped land, mortgage notes and even more.

A self-directed IRA can be an exceptionally potent investment car or truck, nevertheless it’s not for everybody. Given that the stating goes: with good energy arrives good obligation; and with the SDIRA, that couldn’t be additional legitimate. Keep reading to understand why an SDIRA might, or might not, be for you.

Complexity and Responsibility: With an SDIRA, you have more Command in excess of your investments, but You furthermore mght bear a lot more responsibility.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Gia Lopez Then & Now!

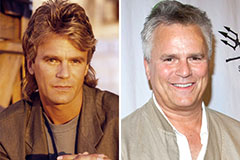

Gia Lopez Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!